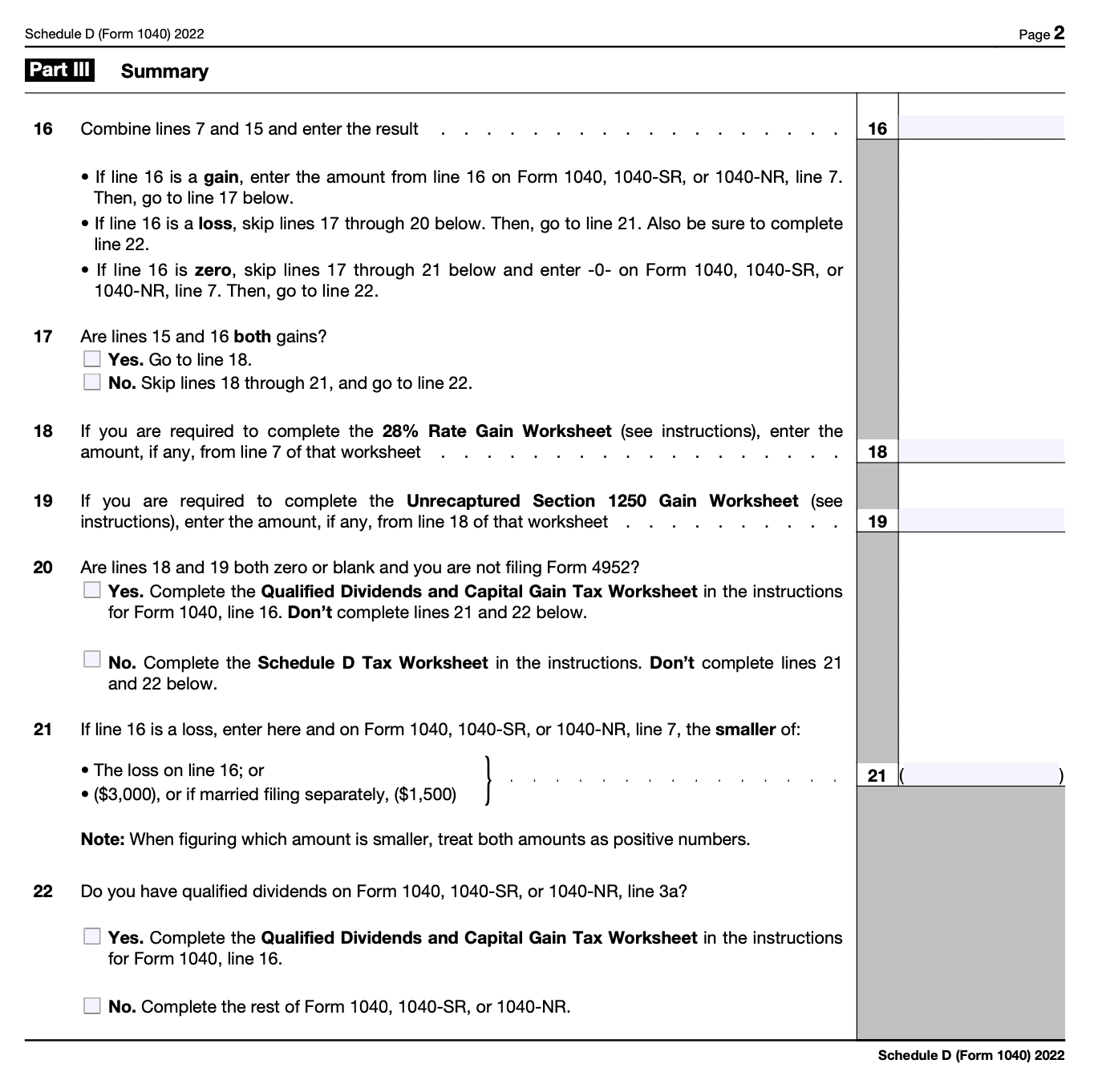

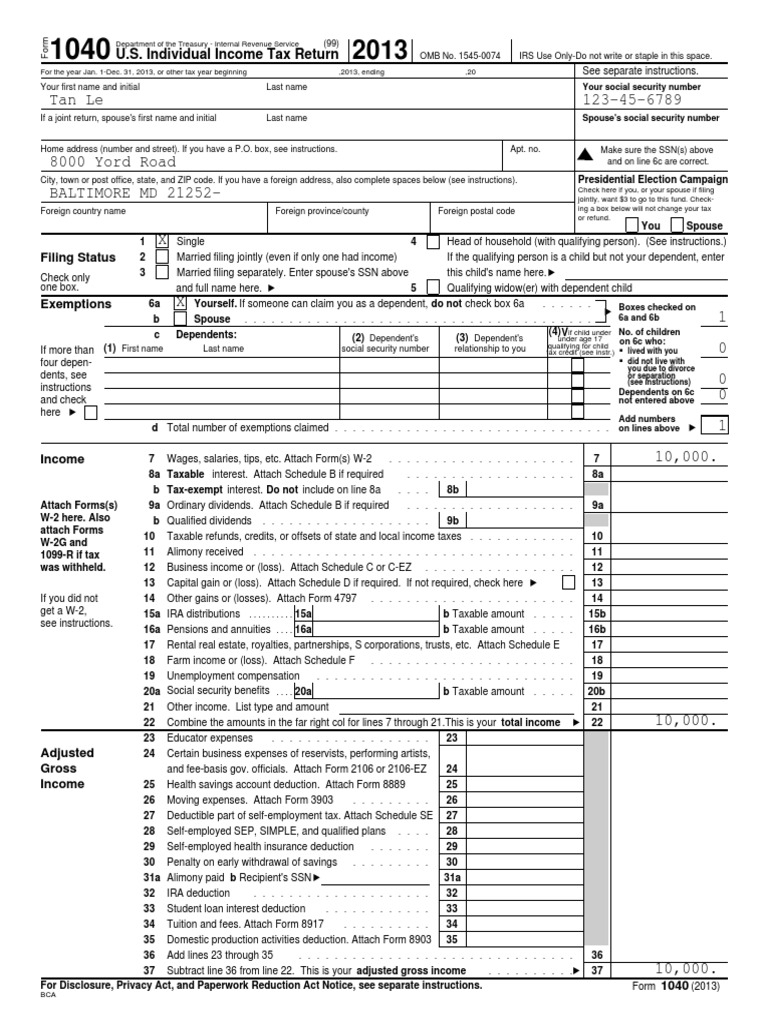

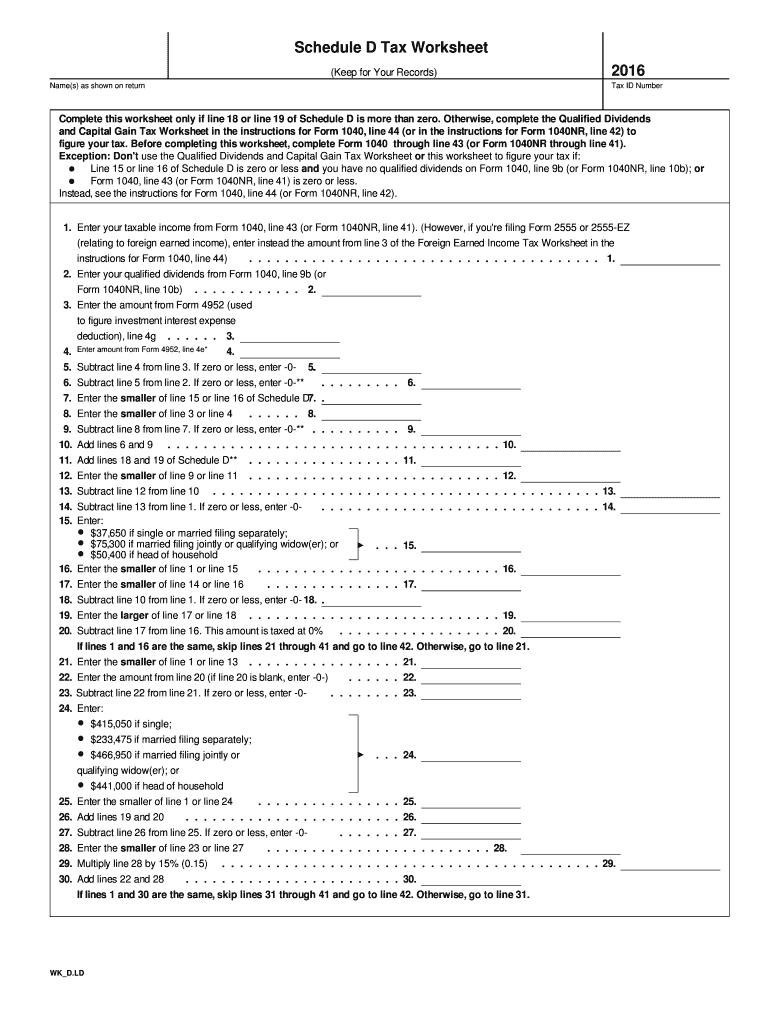

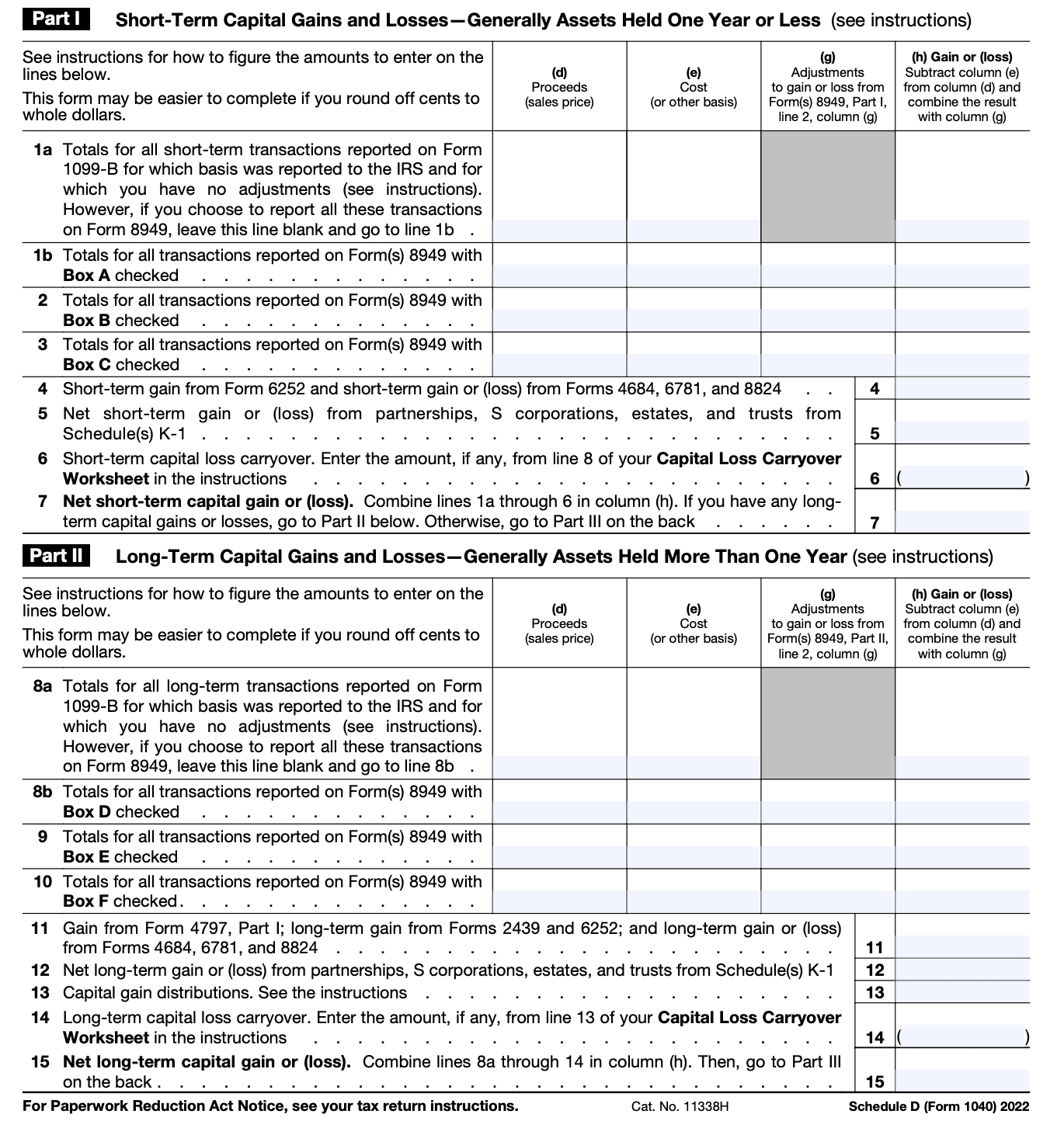

When it comes to filing your taxes, it’s important to make sure you have all the necessary documents and forms in order. One such form is the Schedule D Tax Worksheet, which is used to calculate capital gains and losses. This worksheet is essential for individuals who have sold investments or other assets during the tax year.

By utilizing the Schedule D Tax Worksheet, taxpayers can ensure they are accurately reporting their capital gains and losses to the IRS. This form helps to determine the amount of tax owed on any gains, as well as any potential deductions or credits that may apply.

When completing the Schedule D Tax Worksheet, taxpayers will need to gather information such as the date of purchase and sale of the asset, the purchase price, sale price, and any related expenses or fees. This information will be used to calculate the net gain or loss on the sale of the asset.

It’s important to carefully review and double-check all information entered on the Schedule D Tax Worksheet to avoid any errors or discrepancies. Mistakes on this form could result in penalties or audits from the IRS, so it’s crucial to take the time to accurately complete the worksheet.

Once the Schedule D Tax Worksheet has been completed, it should be attached to your tax return when filing with the IRS. This form will help ensure that your capital gains and losses are properly reported and that you are paying the appropriate amount of tax on your investment income.

In conclusion, the Schedule D Tax Worksheet is a vital tool for individuals who have bought and sold investments or assets during the tax year. By accurately completing this form, taxpayers can ensure they are complying with IRS regulations and avoid any potential penalties or audits. Make sure to download the Schedule D Tax Worksheet PDF and consult with a tax professional if you have any questions or concerns about your capital gains and losses.