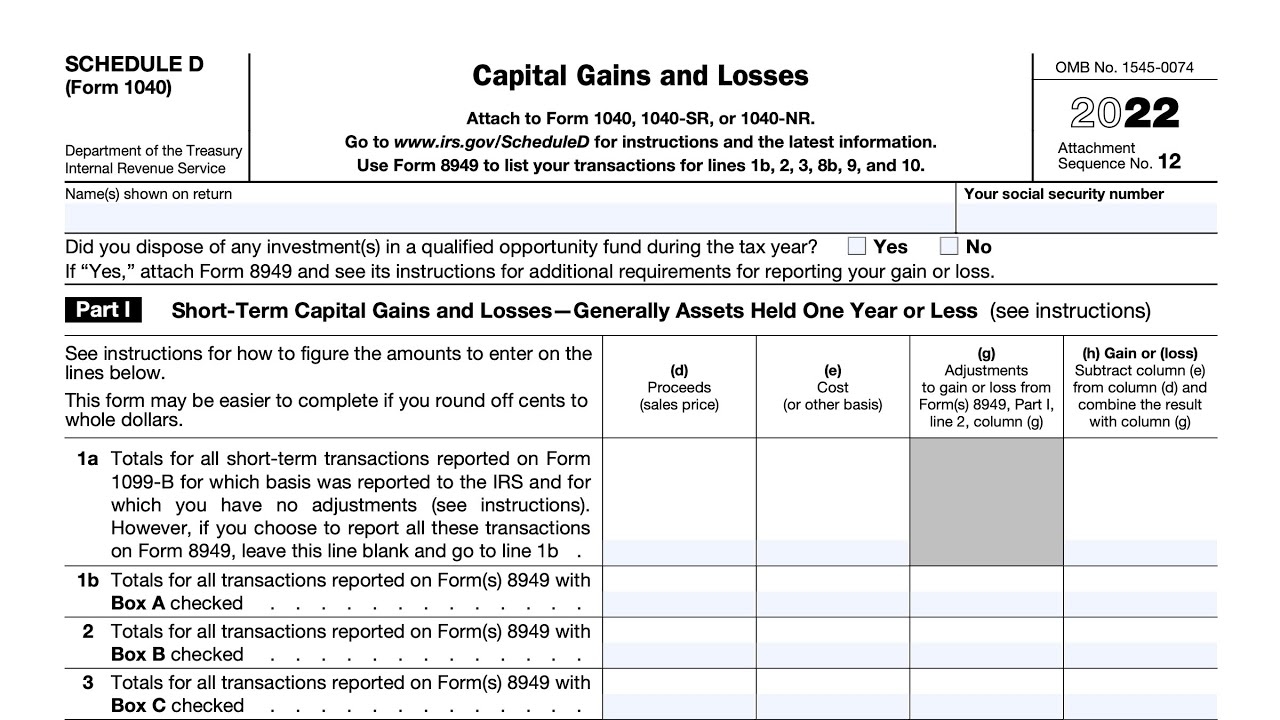

When it comes to filing taxes, it’s important to stay organized and ensure that you are taking advantage of all available deductions and credits. One important form to consider is the Schedule D Tax Worksheet, which is used to calculate capital gains and losses. This form is crucial for individuals who have bought and sold investments throughout the year.

By utilizing the Schedule D Tax Worksheet, taxpayers can report their capital gains and losses in an organized manner, making it easier for the IRS to review and process their tax returns. This form helps individuals determine their net capital gain or loss, which ultimately impacts their overall tax liability.

For the year 2024, the IRS has provided a PDF version of the Schedule D Tax Worksheet for taxpayers to download and complete. This convenient format allows individuals to fill out the form electronically or print it out and complete it by hand. It’s important to carefully follow the instructions provided on the form to ensure accurate reporting of capital gains and losses.

When filling out the Schedule D Tax Worksheet, taxpayers will need to gather information on their investment transactions, including the purchase and sale dates, the cost basis of the investments, and the selling price. By accurately reporting this information, individuals can ensure that they are not overpaying or underpaying their taxes on capital gains.

Once the Schedule D Tax Worksheet is completed, individuals can transfer the necessary information to their Form 1040 or Form 1040NR. This ensures that their capital gains and losses are properly accounted for when filing their tax return. By taking the time to accurately complete the Schedule D Tax Worksheet, taxpayers can avoid potential errors and penalties from the IRS.

In conclusion, the Schedule D Tax Worksheet is a valuable tool for individuals who have invested in stocks, bonds, or other securities. By using this form to report capital gains and losses, taxpayers can ensure that they are in compliance with IRS regulations and maximize their tax savings. The availability of the 2024 PDF version of the Schedule D Tax Worksheet makes it easier than ever for individuals to accurately report their investment transactions and file their taxes efficiently.