When it comes to filing your taxes, it’s important to understand all the forms and worksheets involved in the process. One such form is the Schedule D Tax Calculation Worksheet, which is used to calculate capital gains and losses from the sale of assets. This worksheet helps taxpayers determine how much they owe in taxes on these transactions, making it an essential tool for anyone who has investments or sells property.

Understanding how to fill out the Schedule D Tax Calculation Worksheet can save you time and money when it comes to filing your taxes. By accurately reporting your capital gains and losses, you can ensure that you are paying the correct amount of taxes and avoid any penalties or audits from the IRS. It’s important to take the time to review this worksheet carefully and seek professional help if needed to ensure accuracy.

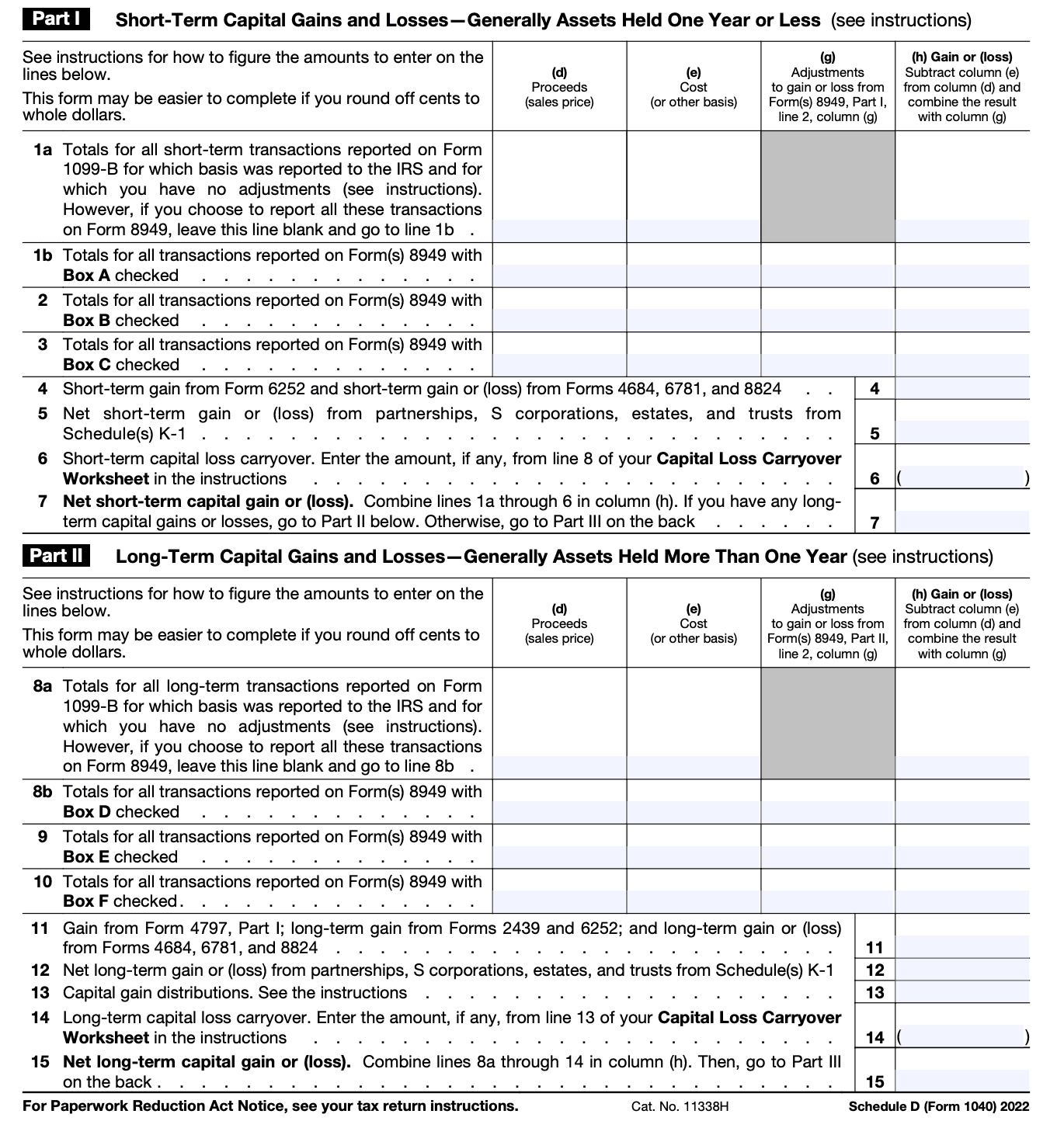

Schedule D Tax Calculation Worksheet

The Schedule D Tax Calculation Worksheet is divided into two parts: Part I, which is used to report short-term capital gains and losses, and Part II, which is used to report long-term capital gains and losses. Taxpayers must first calculate their total gains and losses for each category before completing the worksheet.

Once you have calculated your total gains and losses, you can then use the worksheet to determine your net capital gain or loss for the tax year. This amount will ultimately impact how much you owe in taxes on these transactions. It’s important to follow the instructions on the worksheet carefully to ensure that you are completing it correctly.

There are specific rules and guidelines for reporting capital gains and losses on your tax return, so it’s important to stay informed and up-to-date on any changes to tax laws. By utilizing the Schedule D Tax Calculation Worksheet, you can accurately report your transactions and avoid any potential issues with the IRS. Remember to keep detailed records of all your investments and sales to make the process easier.

In conclusion, the Schedule D Tax Calculation Worksheet is a vital tool for calculating capital gains and losses on your tax return. By understanding how to use this worksheet correctly, you can ensure that you are reporting your transactions accurately and paying the correct amount of taxes. If you have any questions or concerns about filling out this worksheet, don’t hesitate to seek help from a tax professional. Taking the time to review and complete this worksheet can save you time and money in the long run.