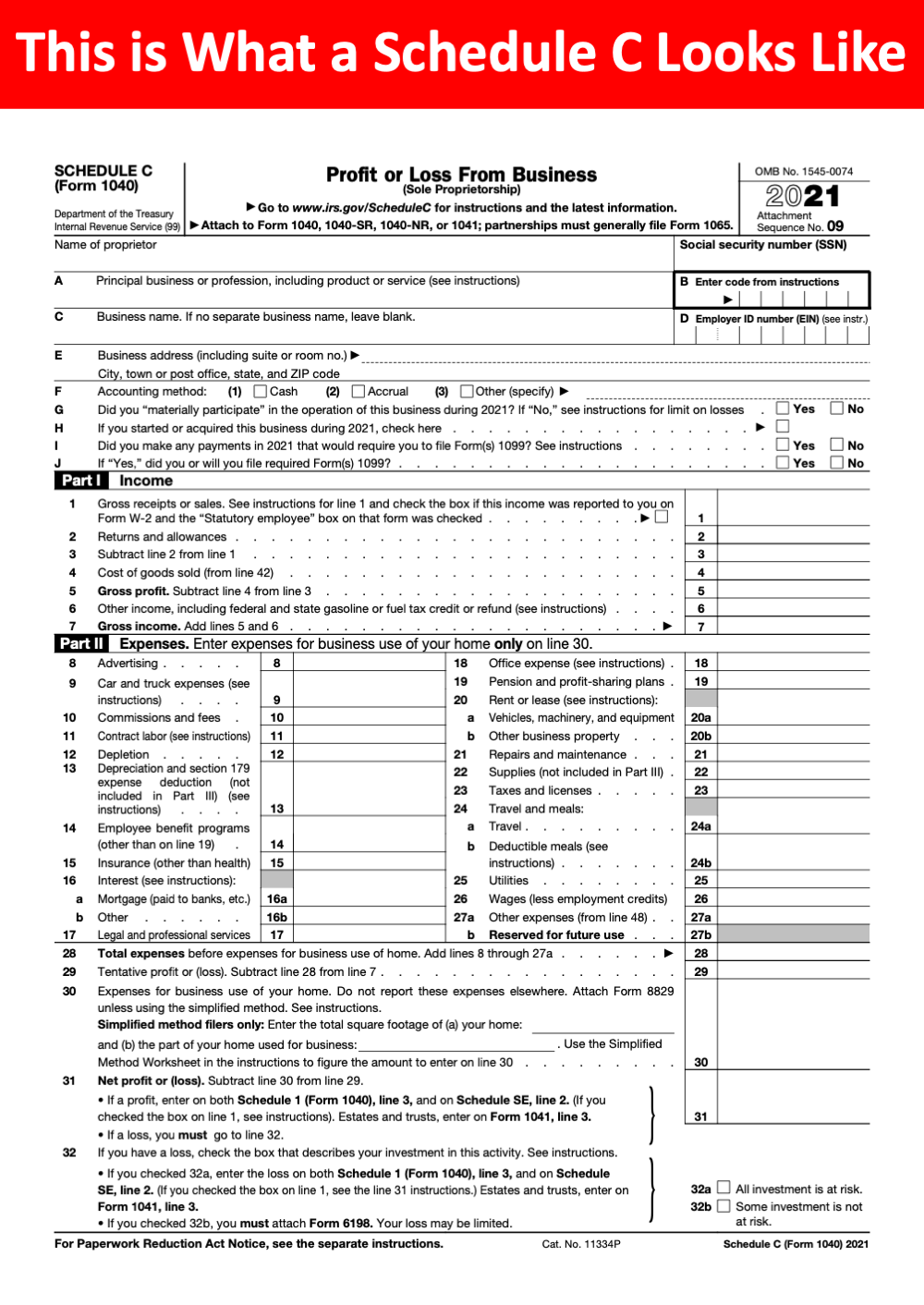

Are you a small business owner or self-employed individual in need of a Schedule C form for tax purposes? Look no further! With our free printable Schedule C form, you can easily report your income and expenses to the IRS without any hassle. This form is essential for those who operate a sole proprietorship or single-member LLC and need to file their taxes accurately.

By using our free printable Schedule C form, you can save time and money by avoiding the need to purchase expensive tax software or hire a professional to prepare your taxes for you. Simply download the form, fill it out with your business information, and submit it along with your tax return to the IRS. It’s that easy!

When filling out the Schedule C form, be sure to accurately report all of your business income and expenses. This includes any revenue generated from your business activities, as well as any deductions or credits that you may be eligible for. By providing thorough and accurate information on your Schedule C form, you can avoid potential audits or penalties from the IRS.

It’s important to note that the Schedule C form is used to report income from a business that is not incorporated. If you operate a corporation or partnership, you will need to use a different form to report your business income. However, for small business owners and self-employed individuals, the Schedule C form is a simple and effective way to report your financial information to the IRS.

So why wait? Download our free printable Schedule C form today and take the first step towards filing your taxes accurately and efficiently. With this form, you can easily report your business income and expenses, ensuring that you comply with IRS regulations and avoid any potential penalties. Don’t let tax season stress you out – use our free printable Schedule C form to simplify the process and get back to doing what you do best – running your business!