Welcome to our article about a blank Schedule C template

Are you a small business owner or freelancer who needs to report your income and expenses to the IRS? If so, you may be familiar with Schedule C, which is a form used to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Having a blank Schedule C template can make this process easier and more organized.

In order to accurately report your income and expenses, it’s important to have a clear and organized template to work from. This template will help you keep track of all the necessary information and ensure that you are reporting everything correctly on your tax return. Let’s take a look at what a blank Schedule C template can offer you.

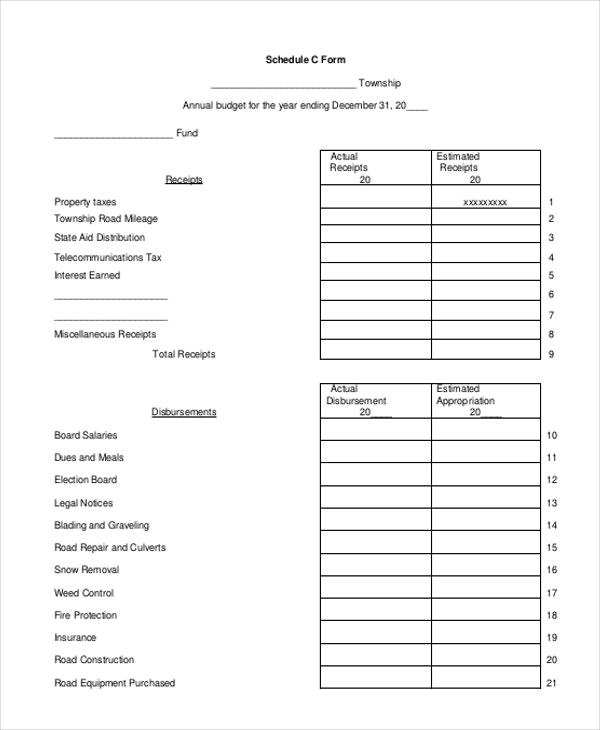

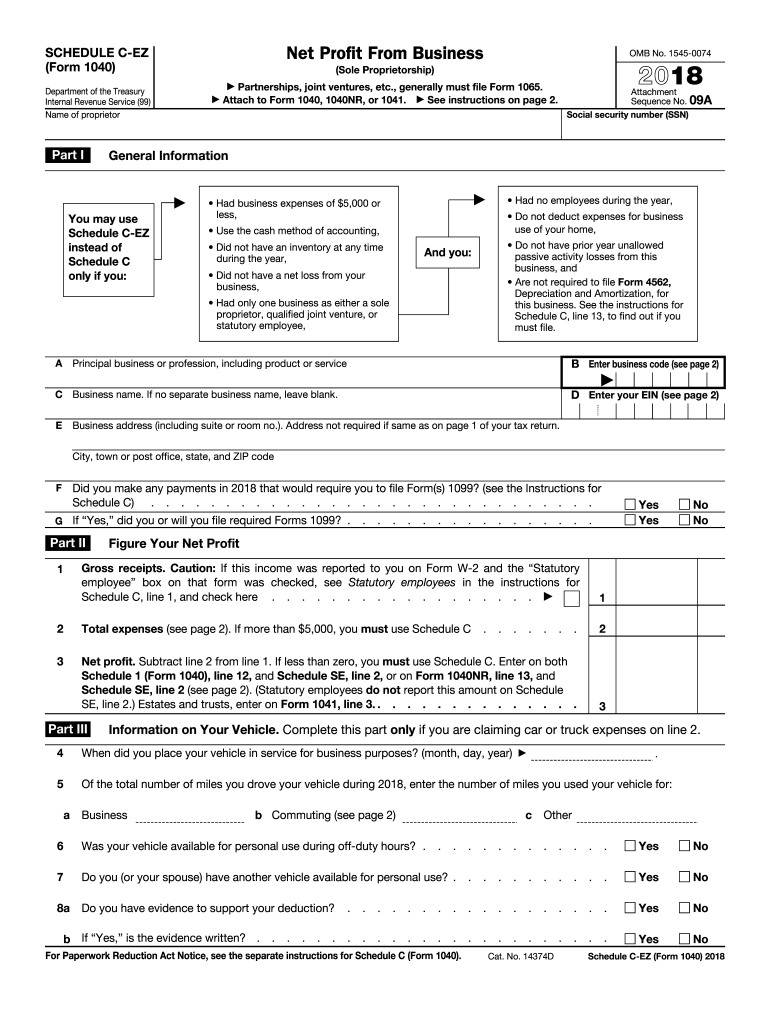

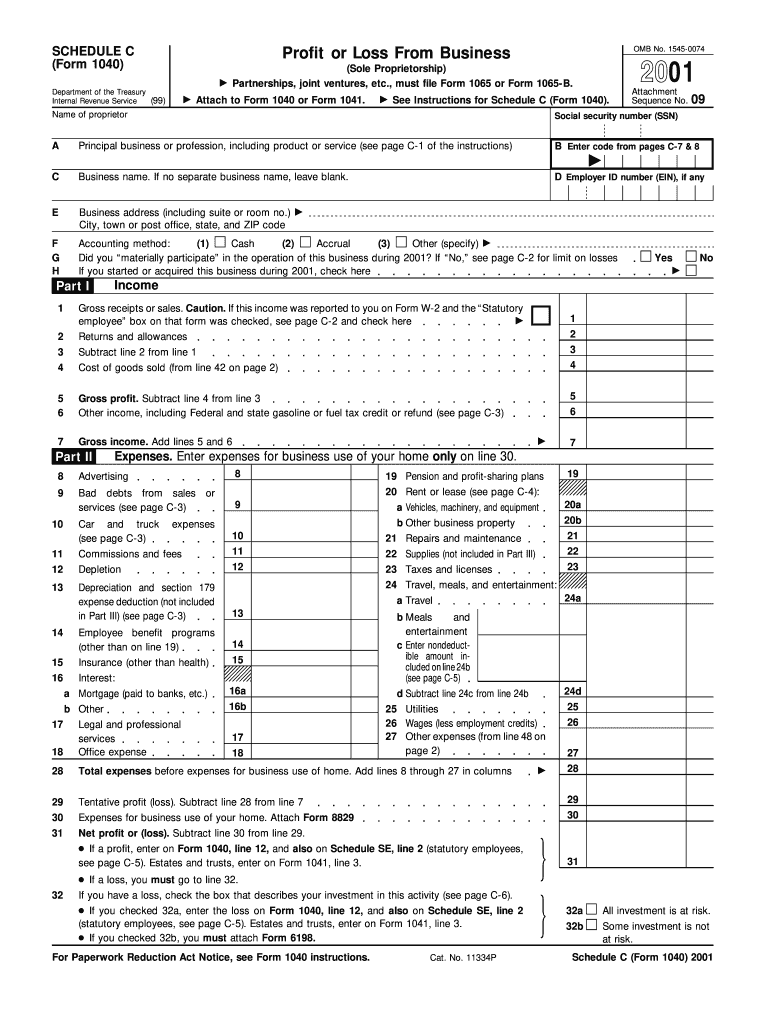

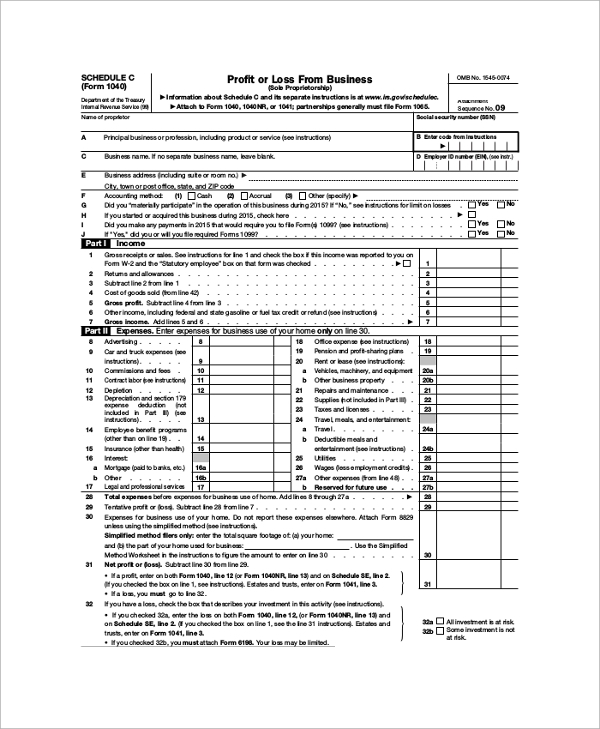

Blank Schedule C Template

A blank Schedule C template typically includes sections for your business information, income, expenses, and deductions. It provides a structured format for you to enter all the necessary details, making it easier for you to calculate your net profit or loss at the end of the year. This template can be customized to fit your specific business needs and can help you stay organized throughout the year.

By using a blank Schedule C template, you can easily track your income and expenses, including any deductions you may be eligible for. This can help you maximize your tax savings and avoid any potential errors when reporting to the IRS. Having a template to work from can save you time and stress when it comes to tax season.

Overall, a blank Schedule C template is a valuable tool for small business owners and freelancers who need to report their income and expenses to the IRS. By using this template, you can stay organized, accurate, and efficient in your tax reporting process. So, if you haven’t already, consider using a blank Schedule C template for your business needs.

In conclusion, having a blank Schedule C template can make a big difference in how you report your income and expenses to the IRS. It provides a structured format for you to enter all the necessary details, helping you stay organized and accurate throughout the year. So, if you’re a small business owner or freelancer, make sure to utilize a blank Schedule C template for your tax reporting needs.