Being self-employed comes with many benefits, but it also requires careful attention to detail when it comes to managing finances. One crucial aspect of being self-employed is keeping track of income and expenses for tax purposes. This is where the Schedule C worksheet comes into play.

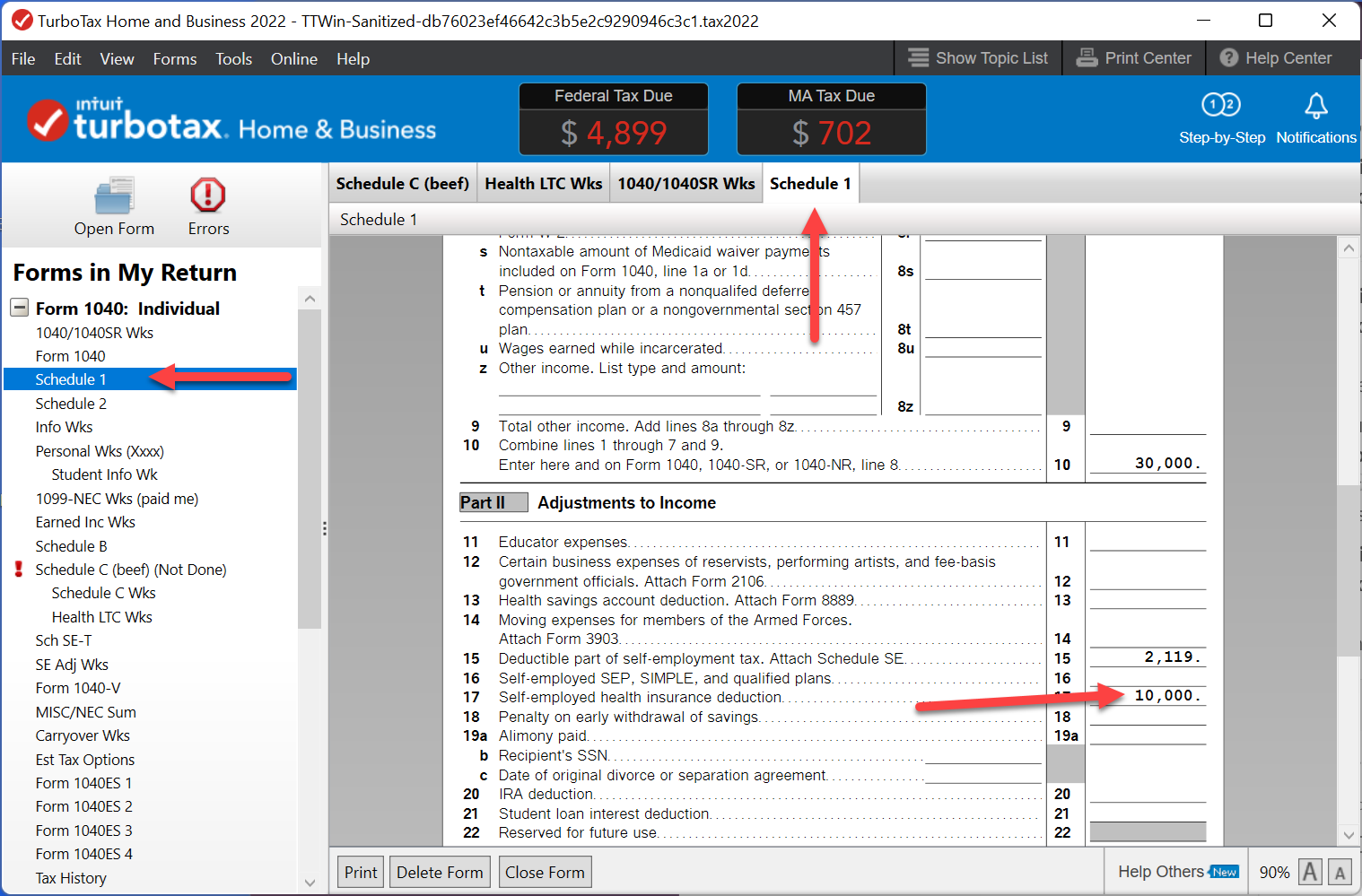

The Schedule C worksheet is a form used by self-employed individuals to report their income and expenses to the IRS. It is part of the Form 1040 and is used to calculate the net profit or loss from a business. This information is then used to determine the amount of taxes owed.

When filling out the Schedule C worksheet, it is important to be thorough and accurate. This includes documenting all sources of income, such as sales, services rendered, and any other payments received. It also involves keeping detailed records of all business expenses, including supplies, equipment, and any other costs associated with running the business.

One of the key benefits of using the Schedule C worksheet is that it allows self-employed individuals to take advantage of various tax deductions and credits that can help reduce their tax liability. These deductions can include expenses such as home office deductions, vehicle expenses, and health insurance premiums.

In conclusion, the Schedule C worksheet is a vital tool for self-employed individuals to accurately report their income and expenses to the IRS. By keeping detailed records and following the guidelines provided on the worksheet, self-employed individuals can ensure that they are in compliance with tax laws and maximize their tax benefits.