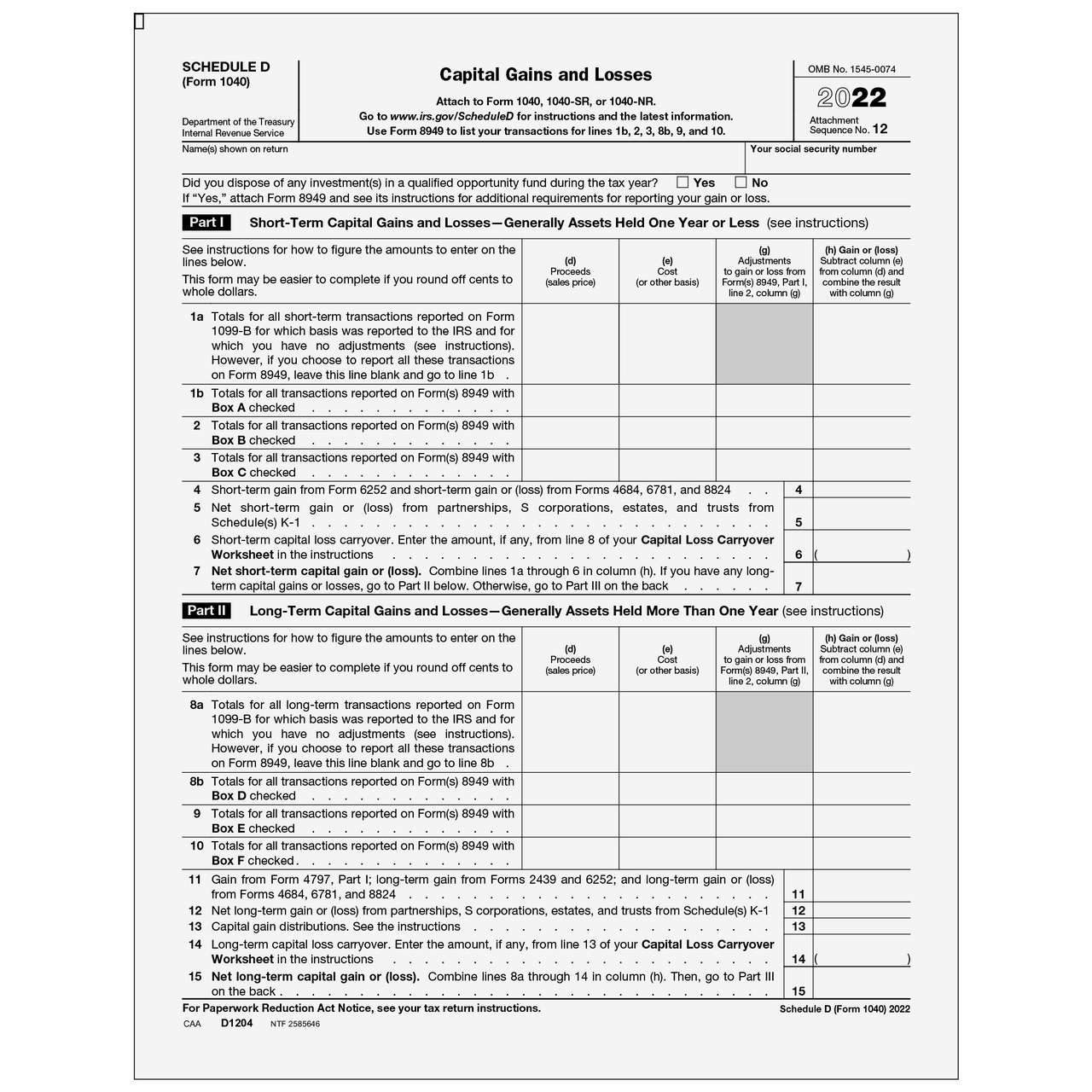

As tax season approaches, it’s important to start preparing early and familiarize yourself with the necessary documents and worksheets. One such document is the Schedule D worksheet, which is used to report capital gains and losses from the sale of assets such as stocks, bonds, and real estate.

Understanding how to fill out the Schedule D worksheet can help ensure accurate reporting of your investment income and deductions, ultimately leading to a smoother tax filing process. In this article, we will delve into the specifics of the 2023 Schedule D worksheet PDF and provide insights on how to effectively complete it.

When filling out the 2023 Schedule D worksheet PDF, it is important to gather all relevant information regarding your capital transactions throughout the year. This includes details such as the date of purchase and sale, the cost basis of the asset, the selling price, and any associated fees or commissions.

Once you have compiled all the necessary data, you can begin the process of completing the Schedule D worksheet. This involves categorizing your transactions as either short-term or long-term capital gains or losses, depending on the holding period of the asset. You will then calculate the net gain or loss for each category and transfer the totals to your tax return.

It’s essential to review your completed Schedule D worksheet carefully to ensure accuracy and consistency with your financial records. Any discrepancies or errors could lead to potential audits or penalties from the IRS. By taking the time to double-check your work and seek assistance from a tax professional if needed, you can avoid costly mistakes and streamline the tax filing process.

In conclusion, the 2023 Schedule D worksheet PDF is a vital tool for reporting capital gains and losses on your tax return. By understanding how to accurately complete this document and being diligent in your record-keeping, you can ensure compliance with tax laws and maximize your tax savings. Start preparing early and stay organized to make the most of your investment income in the upcoming tax year.