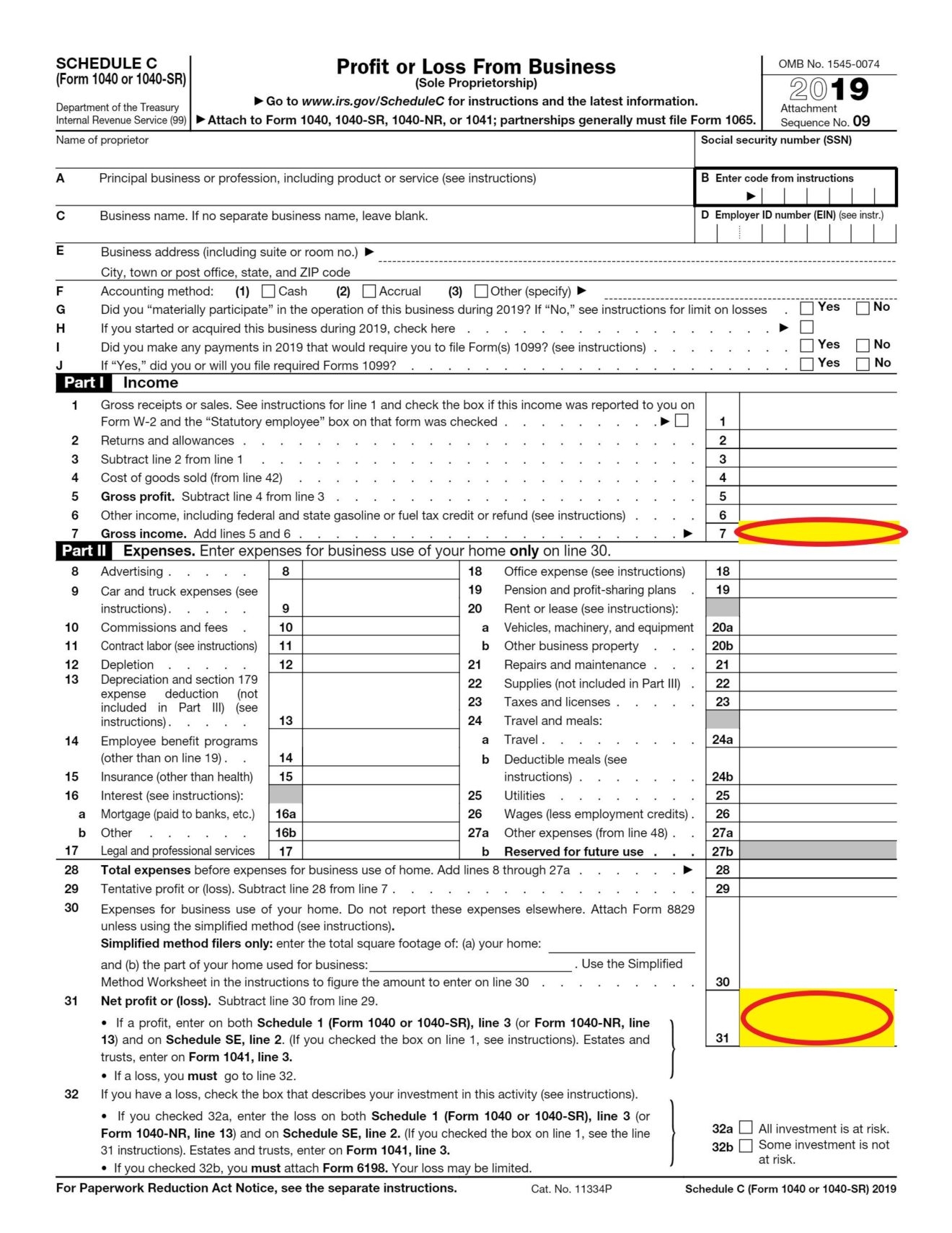

As a self-employed individual or independent contractor, filing taxes can be a bit more complicated than for those who receive a W-2 form from an employer. One important form that you may need to familiarize yourself with is the 1099 Schedule C. This form is used to report income and expenses from a business you own or operate as a sole proprietor.

When it comes time to file your taxes, having a printable version of the 1099 Schedule C can be incredibly helpful. This allows you to easily fill out the form, keep track of your income and expenses, and ensure that you are accurately reporting your business activities to the IRS.

1099 Schedule C Printable

There are many resources available online where you can find a printable version of the 1099 Schedule C form. These forms are typically in PDF format, making them easy to download and print out for your records. Having a physical copy of the form can also be useful for keeping track of your business finances throughout the year.

When filling out the 1099 Schedule C form, you will need to report your business income, expenses, and any deductions you may be eligible for. It’s important to keep thorough records of all your business activities so that you can accurately fill out the form and avoid any potential issues with the IRS.

Once you have completed the 1099 Schedule C form, you will need to include it with your individual tax return when filing with the IRS. This form helps the IRS determine the profit or loss from your business activities, which in turn affects how much tax you owe or are owed in a given tax year.

Overall, having a printable version of the 1099 Schedule C form can make the process of filing taxes as a self-employed individual much easier. By keeping accurate records and utilizing the resources available to you, you can ensure that you are meeting your tax obligations and avoiding any potential penalties or fines.

So, if you are self-employed or work as an independent contractor, be sure to familiarize yourself with the 1099 Schedule C form and take advantage of the printable versions available online to help streamline your tax filing process.